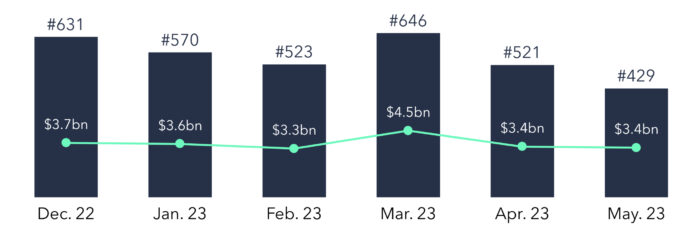

Number and amounts of announced funding rounds over the past 6 months*

*All data from crunchbase, as of June 6th, 2023

IT startups take 2. place for most popular investment industry

- During the month of May, 429 financing rounds were announced.

- The total amount invested in the announced financing rounds stayed at $3.4bn from from April.

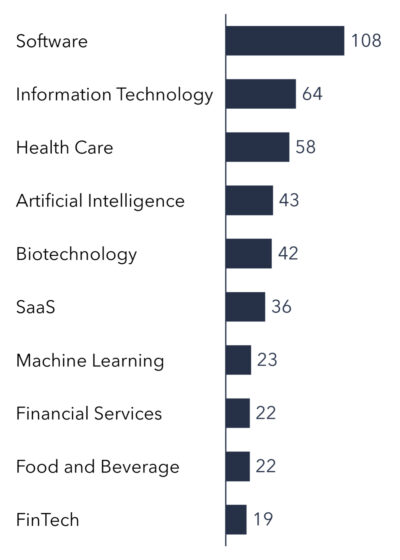

- Once again, most investments were made in Software companies, amounting to 108 investments, followed by information technology (64). In May, investments in health care companies once again make up the third place (58).

Top 10 industries of financed startups according to the number of conducted investments

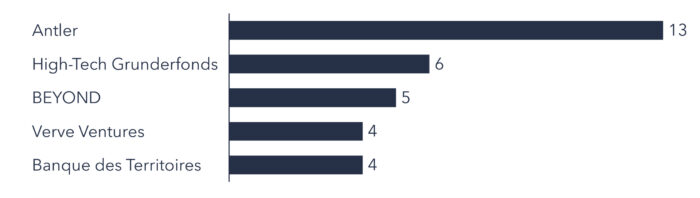

Antler is the most active investor of May; 178 seed rounds were conducted

Investors with the highest number of investments in May

Number and total volume of financing rounds per stage

Largest round of May was a Series D Round of $250.0mn

In May, most investments rounds were Seed Rounds (~42%). Despite that, over a volume of over $1 billion was invested in 96 Venture Rounds.

London, UK, is once again the European startup hotspot of the month

- Not only were the most investments conducted in the UK (#98), but the highest volume was also invested there during May ($969.5mn).

- When ranking by investment volume instead of number of conducted investments, Berlin takes the second place. The total of Germany ranking second by volume ($598.0) and number of investments (#63).

In the spotlight: Builder.Ai raised $250.0mn in may in a series d funding round

Company

Industry

Artificial Intelligence/Software

Founded in

2016, London

One-Sentence-Pitch

Builder.ai offers a no-code AI-powered app development platform designed to build and operate software projects.

Financing round

Money raised

$250.0mn

Type of financing round

Series D

Comment/Quote

Builder.ai announced a newly raised a Series D funding round on May 23rd. Jungle Ventures and Insight Partners invested in the company before, while ICONIQ Capital and Quatar Investment Authority represent new investors.

Investors

Falls Sie mehr über Risikokapitalfinanzierung erfahren möchten, sollten Sie unseren umfassenden Ratgeber zu diesem Thema lesen: Risikokapitalfinanzierung: Ein Leitfaden für Anfänger

Trustventure berät junge Unternehmen zu Herausforderung im Finanzbereich und bietet CFO-As-A-Service-Leistungen an. Die Expertise in Fragen zur Unternehmensfinanzierung, Planung und zum Controlling schafft Transparenz und Sicherheit für Sie und Ihre Investoren. Melden Sie sich gerne über unser Kontaktformular oder schreiben Sie uns direkt an office@trustventure.de.